The Australian Labor Party has a love, hate relationship with superannuation – and what’s not to love about a pool of money, now the fourth largest in the OECD. Ominously, it seems this has been earmarked for deployment to fund the ‘nation building’ objectives of government.

What is not so loved is the realisation that they have designed an excellent system for funding retirement, with the result that some people have accumulated millions of dollars by availing themselves of the legislated tax breaks and opportunities – while low wage earners and/or the unemployed allegedly gain little to nothing from it.

That’s not to say that governments on both sides of politics have not had their share of culpability where meddling with our superannuation system is concerned. What has been lost in the current logic is that thanks to that superannuation system, 90 per cent of Australia’s population has taken responsibility for improving their own retirement incomes, with more and more people self-funding (in full or in part) their retirement now. The government must avoid becoming obsessed by the extremes.

Consider for example, how a tax-free home in Sydney worth $3,000,000 differs from $3,000,000 in superannuation.

Concessional superannuation contributions are taxed at 15 per cent on the way in, with a further 15 per cent tax on earnings in accumulation phase. At the end, the residual value payable to the member’s estate (or non-financially dependent beneficiaries) is subject to a Death Benefit Tax at the rate of 17 per cent.

There is no tax claw-back on the residential home. In fact, under the present system, if Atlassian co-founder Mike Cannon-Brooks was left with just his $130 million+ Sydney harbourside mansion, he would be entitled to full Centrelink benefits, with NO personal CGT payable (or payable by his estate on his death).

Where is the logic in one being good and the other bad?

If the current government is in pursuit of tax revenue from the wealthy, there is substantially more revenue in a CGT exemption which is limited to the first $3,000,000 of the residential home, with the same exemption limit applied to the Centrelink asset test.

This approach would raise more tax revenue and save more in Centrelink outlays than going after a small number of superannuants with large super balances. Thanks to the Total Super Balance (TSB) and Transfer Balance Cap (TBC) the group of people who have and will ever have $3,000,000+ in super and pensions is rapidly reducing.

Treasurer Jim Chalmers wants a national conversation about superannuation – but what the nation needs is a mature discussion around wealth creation in the broader sphere.

Revisiting the tax and Centrelink ‘holy cow’ that is the principal residence is significantly more equitable than a $3,000,000 TSB cap, which in essence is an attempt to reinstate some form of the old Reasonable Benefits Limit (RBL) system removed by the Liberals under the tinkering of then Treasurer Peter Costello.

As for Labor’s fallacious reasoning that there is now a need to define the purpose of superannuation in legislation in order to achieve their broader social objectives, I recommend that the government look to the super ‘Sole Purpose Test’ which has already been defined for nearly 20 years in the Superannuation Industry Supervision (SIS) Act and Regulations.

If they care to revisit their history, Paul Keating and Bill Kelty made it universal with 3 per cent Productivity Super in 1987 under the OSSA Act and Regs (1987). As this measure applied to only those workers covered under an award, Keating made it fully universal with the SG legislation, in 1992. Next came the Superannuation Industry Supervision (SIS) Act and Regulations in 1993 which defined the purpose of superannuation, as well as bringing in Preservation and all the prudential rules around super.

In summary, the SIS legislation directs superannuation trustees to maintain the fund for the sole purpose of providing retirement benefits for the members, or to their dependants if a member dies before retirement. It charges said trustees with obligations to make investment decisions solely in the interests of members, to whom these benefits ultimately belong; investment decisions cannot be directed for other purposes.

Superannuation is meeting this mandate, and with it, providing dignity in retirement. The following examples are cases in point:

- I have clients aged in their early 60s who can’t live with hip pain or the torture of a two-three year wait on the public system, who are able to have a double hip replacement carried out privately, and immediately, at a current cost of $42,000. If their super is where they have the cash, then they should have access to these funds.

- My client in his mid-seventies, a former business owner, was involved in a legal dispute which unfortunately, he lost. The costs of $150,000 had to come from somewhere, and his superannuation was the only flexible asset available. (Seventy-five is not a time in a person’s life to start renting).

Because of his legal case, my client felt that his financial world had collapsed, however, we were able to restructure his finances and ensure he still has a decent income. His gratitude was immense, but all we were doing was using the system established since the birth of superannuation to give him dignity in his retirement. He will now be eligible for part Centrelink Pension earlier than predicted, which will ensure his quality of life is maintained.

That is the beauty of the three pillars of Australia’s Retirement Incomes Policy. While the current system is not perfect, it is still one of the top three retirement systems in the world.

Perhaps the most frustrating issue for all Australians is that both major political parties have tinkered relentlessly with retirement savings policy. Historically, the conservative side of politics has struggled enormously with superannuation. It was after all, Keating’s baby (with significant help from then ACTU Secretary Bill Kelty) and therefore is the devil’s work.

More recently, the Liberals opened the door to the current $3,000,000 super cap debate, with then Treasurer Scott Morrison introducing the other retrospective $1,600,000 Million TSB and TBC cap rules on 1 July 2017. But it was former Liberal Treasurer Costello (again) who started all the noise when he removed the old RBL rules that would have taxed excessive super amounts.

To revisit my Media Release No 12 on 15th March 2008:

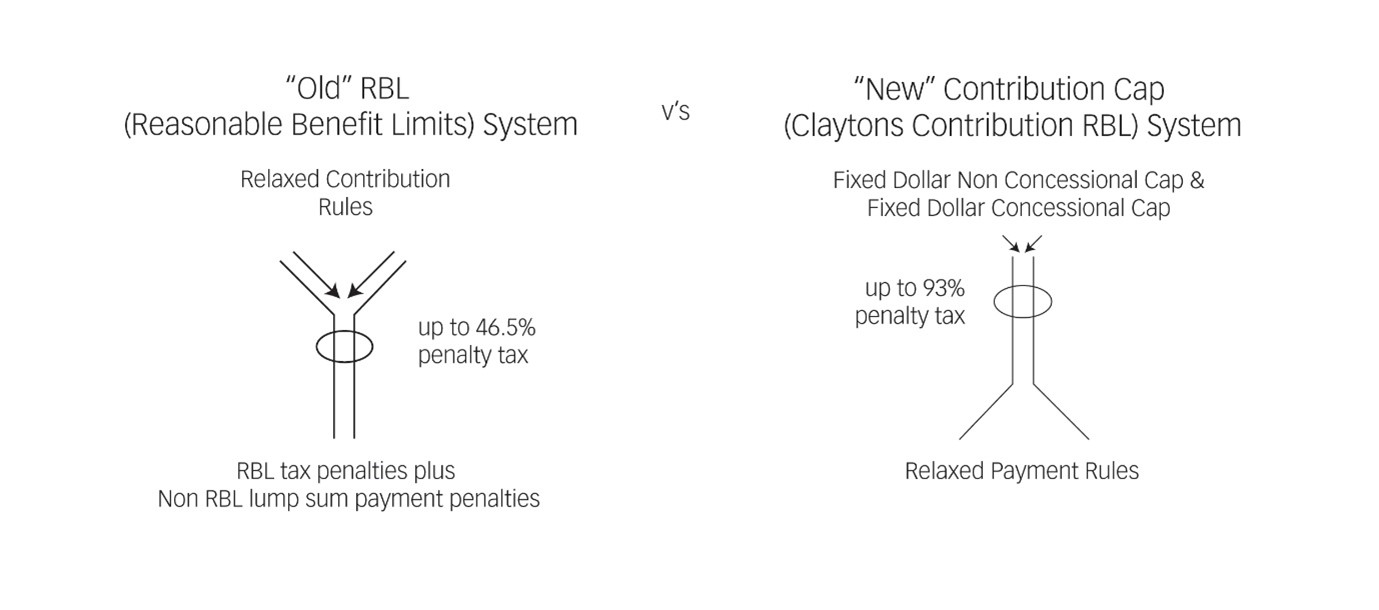

“The most recent changes to super policy have effectively turned the ‘funds funnel’ on its head. In the past, the funnel narrowed at the Reasonable Benefit Limit, $1.2 million for a couple before the 30 June 2007 change, but it was wide open when it came to putting cash in to super.”

“Now the ‘funds funnel’ is tipped upside down, with the limit being on how much you can put in, with as much as you like falling out the bottom,” said Theo.

Either way, the legislation still severely limits how much wage and salary earners can put into their retirement savings.”

It was the current opposition who created the “problem” in the first place.

Remember too, that most, if not all super changes in the past could generally only be legislated with the support of the opposition in Parliament (on both sides) at different times. The hypocrisy of our adversarial political system remains constantly on show.

Without the constant interference of successive governments and their public servants over the last 15 years, we would not currently be facing yet another policy struggle over our $3.3 trillion superannuation pool. As a nation, we should (as we currently do) have a world-class system which, if the rules were left alone, would allow someone at age 35 to have a clear idea of what their retirement income is likely to be, what their home is likely to be worth, and /or what their Centrelink Pension is likely to be – so that they can get on and work hard towards achieving the sole purpose of superannuation.

This can only occur when the political dishonesty and double-speak ends, and when, prior to an election, we can finally believe the rhetorical “we are planning no changes to super!”